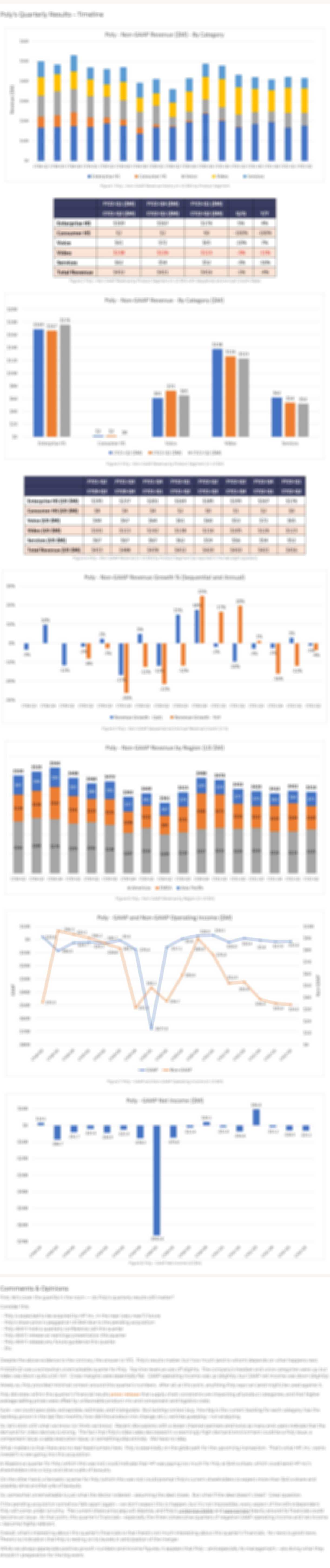

This From Wall Street note provides information, opinions and insight on Poly’s financial results.

[ More information on Poly ]

Current Highlights

- GAAP revenues of $416M, down 4% year over year and 1% quarter over quarter

- Video revenue of $123M, down 11% year over year and 3% quarter over quarter

- Headset revenue of $176M, up 2% year over year and 4% quarter over quarter

- GAAP operating income of -$15M, up from -$20M a year earlier and -$17M last quarter

- GAAP net income of -$33M, up from $36.8M a year earlier and down from -$30.9M last quarter

Notes

- Poly’s fiscal quarters and calendar quarters are different. We use calendar quarters to facilitate comparisons between companies.

- Poly started trading under the ticker symbol POLY on May 24, 2021.

- On March 28, 2022, HP Inc. announced a definitive agreement to acquire Poly in an all-cash transaction for $40 per share (total value of ~ $3.3B), inclusive of Poly’s net debt.

- Poly did not conduct a results conference call or provide an earnings presentation this quarter. However, the company announced its results in a press release and filed its 10-Q and 8-K reports in August 2022.

- Poly did not release per-category revenue figures last quarter. For this reason, sequential growth figures within this report are estimated.

- Poly’s stated Headset revenue growth (up 2% YoY) reflects a combination of its enterprise and consumer headset categories, while our revenue growth calculation (up 4% YoY – see below) considers each category separately.

- For the last few years, Poly has reported non-GAAP revenue. However, the company started stating GAAP revenue at the end of its last fiscal year. This primary difference between Poly’s GAAP and non-GAAP revenue is an ~ $2M deferred revenue adjustment in its Services category caused by its Polycom acquisition in July 2018. Poly’s stated Services revenue growth this quarter (down 14% YoY) reflects GAAP revenue, while our revenue growth calculations (down 16% YoY – see below) reflect non-GAAP revenue.