Quarterly update including financial information and Recon Research’s opinions and insights

Current Highlights

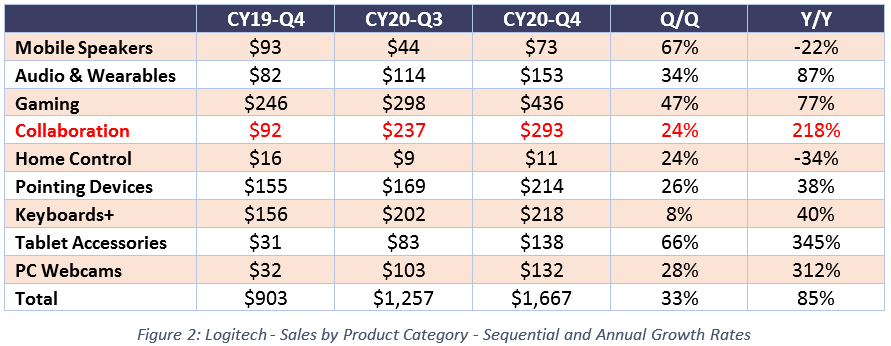

- Logitech hit it out of the park with sales of $1.67 billion, up 85% in US dollars and 80% in constant currency (year over year).

- Operating income grew 248% to $448 million (compared to $129M in same quarter last year).

- Net income grew to $383 million, up from $118 million a year ago.

- Collaboration sales increased 218% to $293 million (compared to $92M in same qtr last year) and remains the second-largest business segment behind Gaming.

- PC Webcam sales increased 309% to $132M (compared to $32M in same quarter last year).

Results Timeline

It is worth noting what is and is not included in the company’s Collaboration category, although the company does not release any data for individual devices.

Included in the Collaboration Category:

- BCC950

- CC-3000 (No longer shipping)

- Logitech Connect

- Logitech Group

- PTZ Pro 2

- MeetUp

- Rally Camera

- Rally System

- “Business-Class Webcams” including the Logitech Brio, C-925, and C-930 (included in revenue totals, but not unit counts)

- Logitech Tap controller (included in revenue totals, but not unit counts)

NOT Included in the Collaboration Category:

- Consumer Webcams (although some of these do appear in conference rooms)

Comments & Opinions

In a word … WOW.

According to Logitech’s CEO Bracken Darrell, FY2021-Q3 was the biggest quarter (in terms of sales) in the company’s history. The company reported sales growth of 80% (YoY) and that its non-GAAP operating profit more than tripled.

In fact, this quarter’s YoY sales volume growth was greater than the total growth from the three prior years combined. And Q3’s profit exceeded the company’s profit in all of the last fiscal year.

Dare we say it again? WOW.

Webcams for All

Logitech is well-positioned to serve customers in the hybrid work environment – whether they’re working from home, in the office, or in a meeting room. But in the back of our minds, we kept wondering how long it would take before everyone had purchased all the webcams they need. Clearly, we haven’t reach that point yet.

Based on anecdotal data from Logitech partners, customer demand for Logitech webcams is still way beyond supply. Word on the street is that some resellers stopped pitching Logitech webcams during the prior quarter due to lack of inventory. Imagine what will happen when Logitech fills its backlog and those dormant partners re-engage with their enterprise customers. If nothing else, next quarter should be interesting.

Life in the Meeting Room

Logitech is also bucking the trends in the meeting room. Discussions with vendors, consultants, and resellers indicate that enterprise AV sales continue to improve from their March / April 2021 lows. However, the majority of market participants have not seen revenue recover to pre-Covid levels.

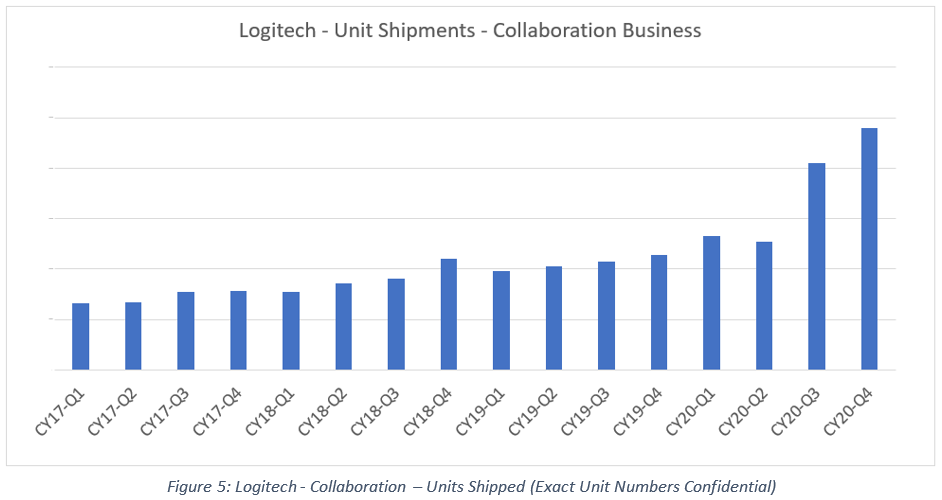

Logitech’s Collaboration division, however, generated significant and consistent growth throughout 2020. Revenue is up to an all-time high of $293M. Unit sales are up. ASPs are up. Conference room system sales are growing at a rate of more than 100% worldwide. And the Collaboration group now generates 18% of the company’s total revenue. Just think how this could look when the masses return to the office.

As stated above, Collaboration has become the second-largest business segment at Logitech. However, if the revenue from consumer webcams (the company’s PC Webcams division) was credited to the Collaboration division, Collaboration would be roughly the same size as the Gaming division and would represent more than a quarter of the company’s total sales. Far be it for us to tell Logitech how to categorize its revenue. However, considering that these consumer webcams are likely being used for collaboration (video conferencing using Zoom, Microsoft Teams, Skype, Google Meet, etc.), such a revenue reclassification might make sense.

Furthermore, this quarter included the holiday season, which is typically big for gaming. In addition, the Collaboration division’s growth rate is higher than that of the Gaming division. Given this, it seems likely that Logitech total Collaboration revenue (combination of the Collaboration and PC Webcams divisions) will exceed that from Gaming in the near future.

Also, a few days before reporting its earnings, Logitech announced a handful of new meeting room video solutions including the Rally Bar (shipping by the end of March), the Rally Bar Mini, and the RoomMate computing appliance.

During the earnings call, CEO Darrell referred to the release of these new products as a “refresh of the conference room portfolio.” In this case, we think he’s being far too modest. These products, with their on-board compute and ability to run collaboration apps from numerous vendors, fill a notable gap in the company’s line card. Stated differently, these devices put Logitech on-par or ahead of competitors vying for a spot in the enterprise meeting room.

It’s also worth mentioning that these new products are NOT lower priced than competing offerings. Logitech’s early success in video conferencing came from offering strong performance at an exceptionally low price point. These new products, however, are performance-priced, not value-priced. And frankly, we think that’s just fine. Logitech is no longer the scrappy contender fighting for a seat at the collaboration table. They’ve earned the right to charge a premium for their marquee. [1]

One final note – while we aren’t at liberty to release unit sales figures, in the last four quarters, revenues have grown faster than units. We believe this stems from increased sales of bundles with higher ASPs such as the Logitech Tap bundles and Rally bundles including additional speakers and mic pods. Once the Rally Bar, Rally Bar Mini, and RoomMate products start shipping, we expect ASPs to increase even further.

We’ve said it before, and we’ll say it again. If you still consider Logitech a keyboard and mouse company, think again.

– – – – – – – – – – –

[1] We should also point out that while the list prices of these products may be higher than some competing offerings, Logitech includes three years of hardware and software maintenance with each purchase, which reduces the total cost of ownership.