This From Wall Street note provides information and RR’s opinions and insight on Zoom Video Communications’ financial results.

[ More information on Zoom ]

Current Highlights

Quarterly Update

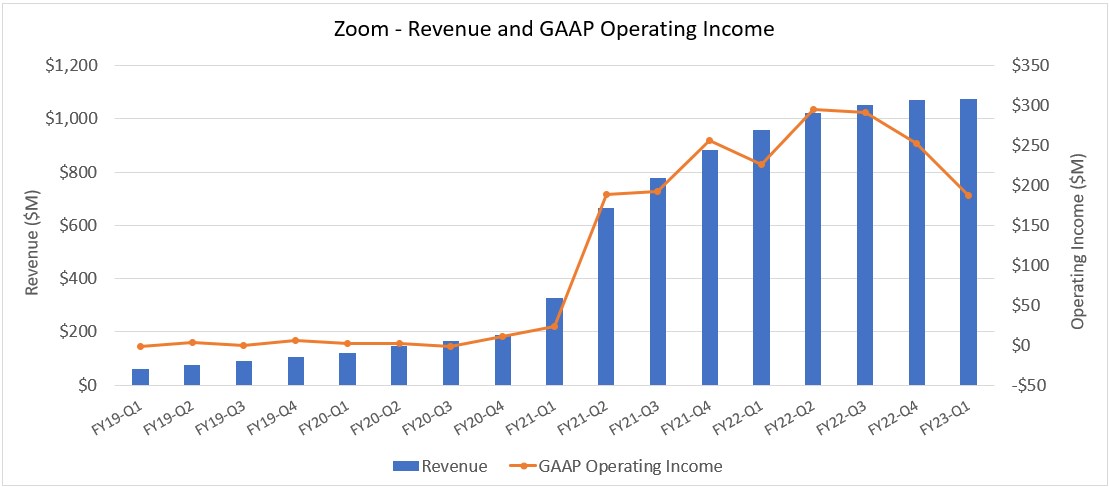

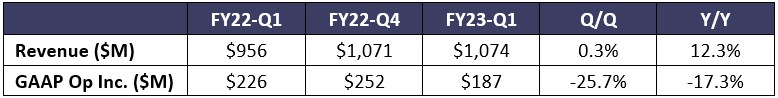

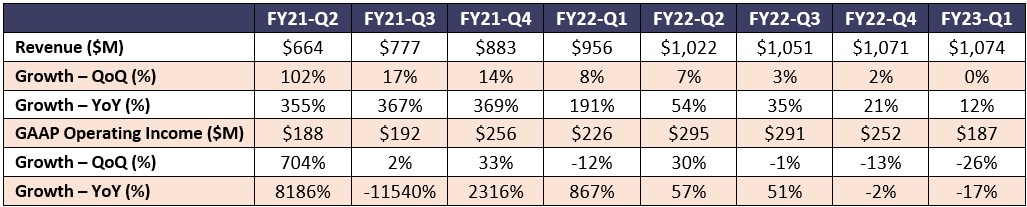

- Total revenue $1.074M for the quarter, essentially flat QoQ and up 12% YoY

- GAAP operating income $187M, down 26% QoQ and 17% YoY

- Number of customers contributing > $100K in trailing 12 months at 2,916, up 46% YoY

- Number of enterprise customers at 198,900, up 24% YoY

Notes

- Zoom made its debut on the Nasdaq on April 18, 2019.

- Zoom’s fiscal year ends January 31, so fiscal quarters and calendar quarters do not align.

Zoom’s Quarterly Results – Timeline

Comments & Opinions

From a Wall-Street trader perspective, FY2023-Q1 was a good quarter for Zoom as it met top-line revenue expectations ($1.07B actual vs. $1.07B expected) and significantly exceeded earnings estimates ($1.03 per share actual vs. $0.87 per share expected).

Furthermore, in last quarter’s write-up on Zoom’s financials, we started this section with one question: “growth, oh growth, where are you?” During this quarter’s conference call, Zoom provided an answer to that question. According to Zoom, growth is coming — and it’s coming during FY2023.

In response to the above, Wall Street rewarded Zoom with a ~ 16% share price pop. Notably, Zoom’s share price is down ~ 85% since its all-time high in October 2020.

With the Wall Street perspective out of the way, we can dig into the rest of the story.

From a revenue perspective, this was another quarter of slowing revenue growth. To be clear – Zoom’s revenue did not decline this quarter. Sequential revenue growth was 0.26% this quarter, which is essentially flat.

Figure 4 above brings the revenue growth concern into specific relief. The blue bar showing QoQ growth is no longer visible this quarter, and the orange line showing YoY growth looks like the bottom of a double-diamond ski slope.

If things don’t change quickly (meaning during this current quarter), we may see Zoom’s first quarter of negative revenue growth since its IPO more than three years ago. Yes – we live in interesting times.

A sequential revenue decline would certainly not be ideal. And Wall Street would likely punish Zoom’s share price in response. However, we see things a bit differently.

Zoom’s growth during the pandemic was unsustainable. Now, Zoom’s revenue is rationalizing.

Sure – we’d prefer a pattern of consistent growth, but we can’t have everything. Zoom is facing real-world challenges and headwinds, including:

- The delayed return to the office and tenuous state of hybrid work at many organizations

- The ongoing commoditization of the generic video meetings market (see our recent Enterprise Connect 2022 video for more information)

- The impact of the Russia-Ukraine war – mostly on online sales (EMEA revenue was flat YoY, while YoY revenue grew by 15% and 21% in the Americas and APAC respectively)

- Significant competition from competing calling vendors, especially Microsoft

But if we zoom out a bit (sorry – I couldn’t resist), we see that Zoom is doing the right things to diversify its offerings, protect itself from price erosion and commoditization, and differentiate itself from competitors.

For example, during this quarter …

- Zoom released Zoom Contact Center, an omnichannel, video-centric contact center solution integrated within the Zoom platform.

- Zoom launched Zoom Whiteboard, enhancing Zoom’s existing e-whiteboard capabilities with new features such as shapes and connectors, the ability to drag and drop images, sticky notes, messages, and more. We spent a few minutes playing with Zoom Whiteboard, and we definitely like what we saw.

- Zoom launched Zoom IQ for sales – a conversational AI solution that analyzes customer interactions and provides insights and actions based on content from sales meetings. While we haven’t tried Zoom IQ for Sales yet, the dashboard screenshots we’ve seen are impressive. For example, Zoom IQ for Sales provides information about a person’s talk time, talk speed, patience level, and even whether the salesperson identified the appropriate next steps.

Other examples include:

- Zoom Phone, the company’s PBX / telephony offering that just reached 3 million seats

- Zoom Events, a virtual event platform launched in May 2021

Also, the company just closed its acquisition of Solvvy, a Conversational AI company focused on improving agent productivity and providing better customer service experiences. The Solvvy acquisition strengthens Zoom’s contact center story.

Some of these releases (e.g., Zoom Whiteboard) are evolutionary in nature and fall squarely into the “why should a company choose Zoom” camp.

But others (e.g., Zoom Phone, Zoom Events, Zoom Contact Center, Zoom IQ for Sales, etc.) significantly expand Zoom’s total addressable market.

To be clear – we’re optimistic about Zoom’s future success with these offerings. And Zoom is naming names of those who have expanded beyond Zoom Meetings and into other areas. For example …

- TeamHealth uses Zoom meetings, Zoom Rooms, Zoom Webinars, Zoom Phone, and most recently Zoom Contact Center.

- Humana and Avis have added 24,000 and 10,000 Zoom Phone licenses respectively

- Lumio, a solar provider, enabled Zoom Chat for 4,000 of its employees

- FranklinCovey has expanded beyond Zoom Meetings and now also uses Zoom Contact Center

However, we’re not convinced that these new revenue engines will contribute quickly (and significantly) enough to offset the revenue headwinds and possible revenue decline caused by the commoditization of the generic video meetings market.

[ Author’s Note – the exception is Zoom Phone which is already performing quite well. ]

Looking back to the financials, non-GAAP margins were up this quarter. According to the company, this increase was the result of optimized usage of public cloud networks and the company’s increasing number of co-lo data centers.

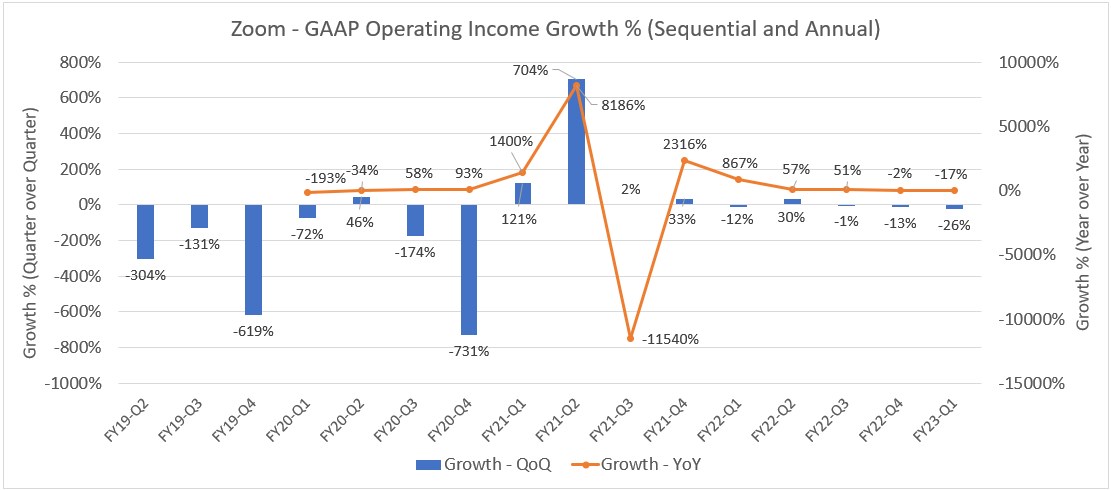

In addition, while non-GAAP operating income was flat YoY, GAAP operating income growth rates QoQ and YoY were deep into negative territory this quarter (see Figure 5 above). Again – this does NOT mean Zoom’s operating income is negative. The company reported a GAAP operating income of $187M this quarter, which is down significantly from prior quarters.

[ As an aside, this quarter’s GAAP operating income reflects stock-based compensation expenses, related payroll taxes, net losses on strategic investments, litigation settlements, acquisition expenses, and more. ]

Also, expenses were up significantly this quarter. Specifically, R&D expenses were up 105% YoY, sales & marketing expenses were up 40% YoY, and G&A expenses were up 26% YoY.

OK – so now we’re adding increased spending to the mix. But at the risk of committing sacrilege, this is a good thing.

Zoom is transitioning. Zoom started out as a video meetings company (Zoom 1.0). Over time, it morphed into a UC platform company (Zoom 2.0). Now, Zoom is evolving into a multi-discipline communication and collaboration provider (Zoom 3.0).

Transitions cost money. Developing new solutions (like Zoom Whiteboard, Zoom IP for Sales, Zoom Contact Center, etc.) costs money. Entering new markets costs money. Sales and marketing resources and initiatives cost money. Processing more business costs money.

Zoom has to spend in order to succeed. Now, one could argue that Zoom is spending too much – or not enough for that matter. We’ll leave that alone for now and re-visit Zoom’s expenses in subsequent quarters.

During this quarter’s call, Zoom highlighted its increasing focus and ongoing success working with Enterprise customers. During FY23-Q1, more than half (52%) of Zoom’s revenue came from Enterprise customers, and the total # of enterprise customers increased 24% YoY. Also, the TTM net dollar expansion rate for Enterprise customers was 123%.

At first, one might find this disturbing. After all, Zoom started out as the darling of the masses – not just the enterprise. But that was the old Zoom. The new Zoom needs customers who want additional functionality and are willing to pay more for those benefits. In this regard, Mom and Pop shops and sole proprietorships won’t cut it. Zoom is going where the budgets are, and that’s the right move.

In summary, while we’re disappointed that Zoom’s revenue growth is disappearing, we’re not surprised.

We are not financial analysts. Nor do we have a financial crystal ball. That said, it’s entirely possible that Zoom’s revenue will decline – either temporarily or perhaps even for the long term as it settles at a new level. And frankly — that’s ok.

Zoom is transitioning (and wisely so) out of its home territory and into new markets with an expanded portfolio of new offerings. Such transitions naturally step on company financials.

While the next few quarters may be a bit bumpy and even traumatic, we’re still firmly in the “Zoom can do it” camp.